There are a lot of Medi-Share reviews out there, but I wanted to share my personal experience, particularly regarding Medi-Share maternity sharing.

Whether you’re looking for health insurance, are already a Medi-Share member and just found out you’re pregnant, or have had your baby and are navigating the world of hospital bills and Medi-Share, I’m going to do my best to help you get answers!

Here’s the thing.

When it comes to choosing health insurance, there are so many hard decisions to make. Trust me, I learned this firsthand when I left my corporate job to be a travel blogger.

There are so many layers to finding a good fit for health insurance, from price and coverage to the question of if your insurance provider even accepts this new insurance. And then, when you introduce the concept of Christian medical sharing, you’ve opened a whole new can of worms.

Well, now that I’ve had Medi-Share since 2019, and have now had a baby (in an out-of-network hospital, might I add!) while on Medi-Share, I feel uniquely equipt to share my Medi-Share maternity review with you!

Also, Medi-Share is not paying me to write a review, so this is my complete and honest opinion!

What is Medi-Share?

For starters, Medi-Share is not health insurance. They’ll be the first ones to tell you that!

Instead, it’s a Christian health-sharing program that has been around since 1993 with over 400,000 active members.

Here’s a very simplified look into what health sharing is: Think of how the early church operated in the book of Acts where everyone shared their resources. Medi-Share is a similar concept where funds are shared directly between members based on need.

In fact, you can open your Medi-Share app and see where your funds are going and who they’re helping. You can (and are encouraged to) pray for those people! And others pray for you as well. Literally, every time you call Medi-Share, whomever you speak to will ask you what you need prayer for at the end of the call. They’ll pray over your needs right then and there!

Medi-Share is God-honoring health care that aims to be affordable. It’s also legal to have it as your only health coverage. To join, you must be a Christian as the whole premise of Medi-Share is to share other believers’ burdens in a Biblical way.

Since it’s not health insurance, they use different terminology that can be tricky to understand right away. So here’s a little guide to what you’ll hear and what it corresponds to.

Medi-Share Lingo

| Insurance Terminology | Medi-Share Counterpart |

|---|---|

| Deductible | Annual Household Portion (AHP) |

| Monthly Premium | Monthly Share |

| Group Number | Household ID |

| Member ID Number | CCM ID |

| Annual Check Up | Well-Visit |

Here’s how a doctor’s visit works with Medi-Share:

- Find a healthcare provider on the Medi-Share PHCS network

- Call them to confirm that they accept Medi-Share

- Go to the doctors and show them your Medi-Share card

- Pay a $35 copay (regardless of if you’ve reached your AHP “deductible,” you always pay this amount).

- The doctor’s office will bill Medi-Share

- If you’ve met your AHP “deductible,” then that’s it. But if you haven’t met it yet, Medi-Share will negotiate the best discount that they can, which you’ll then be billed for.

You can request information for Medi-Share through our link below! Medi-Share gives our family a referral payment if you join with this link. It’s at no extra cost to you and would be a tremendous blessing for us financially!

Is Medi-Share cheaper than regular health insurance?

Because it’s a non-profit and they don’t take a premium, you typically will save money when using Medi-Share vs traditional insurance.

Here’s what Medi-Shares pricing looks like at the time of writing this post:

| AHP Amount | Single Person | Married Couple | Family + Kids |

|---|---|---|---|

| $3000 | $313 | $534 | $796 |

| $6000 | $237 | $398 | $587 |

| $9000 | $192 | $315 | $462 |

| $12000 | $141 | $222 | $320 |

When we had James, our monthly cost bumped up from roughly $500 to roughly $800. But it seems like there won’t be a big increase with our next child… I’ll keep you posted!

Why did we choose Medi-Share?

When I left my corporate job in 2019 to become a full-time travel blogger, my husband and I were in need of health insurance.

We chose Medi-Share after comparing health insurance plans and realizing that Medi-Share would save us a lot of money each month.

It’s also great knowing that Medi-Share is a non-profit organization that doesn’t take a premium. Our funds are shared with other believers and pay for their medical needs. (No greedy health insurance company here!)

They also provide free Tele-Health visits through MD Live.

On the travel blogger note, here are some of my articles you might find helpful if you’re pregnant!

The Best Babymoon Destinations in the USA

Flying While Pregnant: What to Know for a Successful Flight

The Top Baby Travel Essentials

What does Medi-Share say about maternity sharing?

Let’s jump into Medi-Share and pregnancy. As you’d expect, maternity costs are shared. But, these bills have limitations depending on your AHP “deductible” level. You can only share maternity bills if you’re at a $3000 or higher deductible (ie. not their $1,000 or $1,750 deductibles).

Additionally, there is a limit for how much you can share for maternity bills: $125,000 per pregnancy.

For your bills to be shared through Medi-Share, either a medical doctor, a doctor of Osteopathy, or a licensed midwife must perform your delivery (see full details here). And yes, that means home births are covered if you use a licensed midwife!

Joining Medi-Share While Family Planning

If you haven’t signed up for Medi-Share yet and are still thinking about it, one crucial thing to know is that you must be married and have faithfully shared from the month of conception through the month of delivery to get maternity costs covered. So if you’re already pregnant, you won’t be eligible for maternity costs. But if you’re not pregnant yet, Medi-Share is a great option! See how much you could save with Medi-Share here!

Your Medi-Share Annual Year

Something to keep in mind, as well, is that with Medi-Share you’re not in the same insurance cycle as regular health insurance.

We signed up for Medi-Share in July of 2019, so our annual year goes from July 1st to June 30th. Since my baby was born in April, our whole maternity process was within one Medi-Share calendar year. What that ended up meaning was that we essentially paid our $3000 AHP “deductible” total and Medi-Share covered the rest.

We didn’t time it out that way or anything! But if he had been born in August, we could’ve conceivably ended up paying $6000 for maternity costs (two of our AHP “deductibles”).

TLDR; Medi-Share offers maternity sharing up to $125,000 per pregnancy if you’re at an AHP (deductible) of $3,000 or more. You must have faithfully shared (paid your monthly amount) from the month of conception to the month of delivery. Once you’ve reached your AHP, all other maternity bills should be covered.

My Medi-Share Maternity Experience

In August of 2021, I found out I was pregnant. We had moved the previous year so I needed to find a new OBGYN near me. I logged into my Medi-Share account to find a new provider and called a few that were close to me.

I landed on Carter, Hays, & Martin since my sister-in-law delivered her babies with Dr. Hays and had great experiences. To double-check that they accepted Medi-Share, I confirmed when setting up my first appointment (they did accept it).

There was just one problem.

Delivering at an Out-of-Network Hospital with Medi-Share

Turns out, my doctor only delivers at Baylor University Medical Center (which I’ll refer to as Baylor), which is an out-of-network hospital.

I discussed it with Brandi, who works for the billing department at my OBGYN office. She told me she’d seen this happen to a Medi-Share patient of theirs before, and knew what to do. Brandi mailed a letter to Medi-Share (and a copy to me) explaining that my doctor only delivers at Baylor. I called Medi-Share to confirm that they had received it, and after taking a bit to search, they did have that letter.

So, what did that letter do?

It made it so that I’d be given a “penalty waiver” with Medi-Share. What that means is that they treat the out-of-network hospital as in-network because of that letter that Brandi mailed.

Practically, what that looks like is me calling Medi-Share with every bill I received to remind them that I had that letter in my file. They’d always take a few minutes to find it (it was never where it was supposed to be), but in the end, they confirmed they had it. Sometimes they’d need me to email them things like payment confirmations or bills that hadn’t been sent to them.

To Sum It Up…

I’ll summarize my experience delivering at an out-of-network hospital into three issues:

- I always had to call and remind Medi-Share about the letter in order to get a “penalty waiver” to get bills treated like they were in-network.

- Every time I got a medical bill from Baylor, I had to send it to Medi-Share. Since Baylor doesn’t bill to Medi-Share, I was the middleman.

- I ended up having to pay a portion of the bills from Baylor out-of-pocket. However, I did later get reimbursed for what I spent via checks from Medi-Share that I received in the mail months later.

But, in the end, it worked. They treated my out-of-network hospital as in-network and those maternity bills got shared.

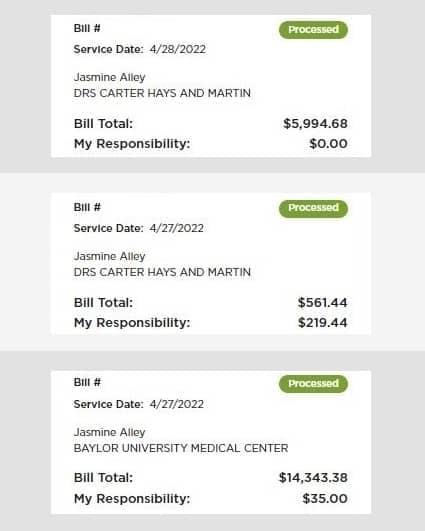

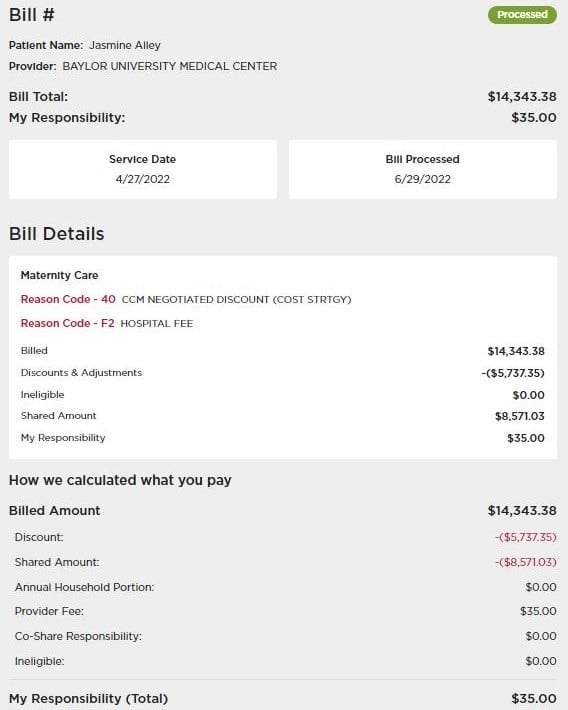

As an example, here’s what the finalized versions of our bills ended up being (I removed the bill numbers just in case it’s sensitive information):

As you can see, because we had reached our AHP, eventually my $14,343.38 bill (just one of many maternity bills that I submitted to Medi-Share) became just a $35 copay. A huge win in my book!

Would I go through it again?

Yep. For future children, I’ll stick with my OBGYN since I love my doctor and the practice, even though we had to jump through some hurdles to get bills paid. Now that I know what to expect and what to do with out-of-network hospital bills, it should be smoother sailing for the (Lord-willing) future children we have.

TLDR; even though my OBGYN was in-network, I had to deal with extra steps since my delivery hospital was out-of-network. But in the end, my maternity bills got paid. Medi-Share maternity sharing is ideal if you go to an in-network OBGYN who delivers at an in-network hospital.

Doctor’s Visits for Your Baby

So, what about after your baby is born? While well-visits (annual check-ups) for adults are not shared, they are for babies up until they turn 6. That includes routine check-ups and associated lab work, but Medi-Share will not pay for vaccinations and/or immunizations.

And on the vaccination and immunization topic, we chose to space them out while still following the CDC guidelines. If you’d like my PDF calendar for what we did (that our pediatrician was fine with since it follows the CDC timeline), send me an email!

In conclusion…

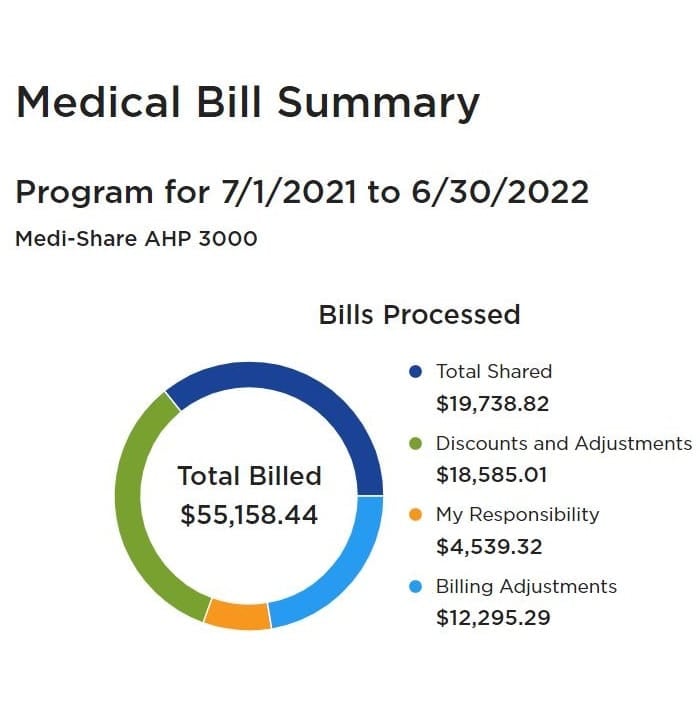

Medi-Share’s maternity policy is pretty great, in my opinion! As you can see, as a family, we were billed a total of $55,158.44 in our annual year. But, we only paid $4,539.32. (Why is that number higher than our $3,000 AHP? Well, this includes things that aren’t covered like various vaccinations for both me and my baby and an out-of-network emergency room visit.)

The best way to make sure it works for you is to find an in-network PCHS provider who delivers at an in-network hospital. Also, make sure you’re at an AHP of $3,000 and that you pay your monthly Medi-Share bills from conception to delivery (and on, of course!).

I hope this Medi-Share review has been helpful to you!

If you have questions or have your own Medi-Share experience to share, let me know in the comments!

And once again, if you’re interested in signing up for Medi-Share, don’t forget to do so through the link below… that referral payment would be a huge blessing to us!

Lastly, here are some more articles you might enjoy:

- The Best US Babymoon Destinations

- Where to Go for the Ultimate Hawaii Babymoon

- My Favorite Items on My Baby Registry

- Tips for Flying While Pregnant

- The Best Baby Travel Essentials

Happy sharing!

Jasmine